India Rupee At 5-Month High On Fed Chair Powell’s Comments

7 January 2019 / Morning Brief

Indian Rupee

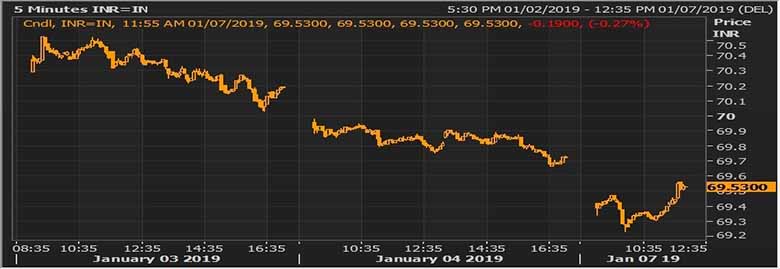

- The Indian rupee little changed at 69.42 pair now at 69.41 against 69.72 previous close.

- Pair to tip in 69.25- 69.55 range today.

- The Indian rupee jumped to a five‐month high against the dollar in early trade, as U.S. Federal Reserve Chairman Jerome Powell’s comments of being flexible in policy decisions hurt dollar demand. U.S. jobs growth still strong and Fed chair seems to be less hawkish, resulting in to a risk on rally in the global markets and supporting gains in the rupee. Foreign lenders have been offering dollars since early trade. However, dollar purchases by state‐run lenders checked further gains in the unit.

Global Currency

- The dollar slipped against peers on Monday, as traders placed bearish bets due to rising expectations that the Federal Reserve would put its policy tightening on pause in 2019. Risk appetites were strong in Asian trade, thanks to China's aggressive monetary easing on Friday to address a sharp economic slowdown and to hopes that Washington and Beijing can strike a comprehensive trade deal.

- The euro was 0.09 percent higher at $1.1401 against the greenback. Earlier in the day, the euro zone single currency fell as low as $1.1347 against the dollar after the dollar rose following data that showed U.S. employers hired the most workers in 10 months in December while boosting wages.

Global Markets

- Oil prices rose by more than 1 percent on Monday, lifted by optimism that talks could soon resolve the trade war between the United States and China, while supply cuts by major producers also supported the market.

- Gold rose on Monday, helped by a weaker dollar on expectations that the U.S. Federal Reserve might apply brakes on its monetary tightening cycle in 2019, although an improved risk appetite limited gains for the safe haven metal.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 69.425 | 69.435 | -0.16 |

| EUR/USD | 1.14221 | 79.30 | -0.04 |

| GBP/USD | 1.27474 | 88.50 | 0.06 |

| USD/JPY | 108.182 | 0.64 | 0.14 |

| SEK/INR | 8.9386 | 7.7669 | 0.0059 |

| DKK/INR | 6.1973 | 11.2025 | 0.0325 |

| AUD/USD | 1.4023 | 49.50 | -0.06 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.52056 | -0.41943 | |

| 3M | 2.80388 | -0.34457 | |

| 6M | 2.85575 | -0.29857 | 1Y | 2.96488 | -0.17700 |

| Index | Today | % Change |

| NIFTY | 10814 | 0.87 |

| SENSEX | 36020.09 | 0.93 |

| BANK NIFTY | 27419.15 | 0.82 |

| SGX NIFTY | 10801.45 | 0.69 |

| NIKKEI | 20092.28 | 2.71 |

| HANG SENG | 25757.90 | 0.51 |

| SHANGHAI | 2530.22 | 0.61 |

| ASX200 | 5683.20 | 1.14 |

| DOW JONES | 23433.16 | 3.29 |

| S&P500 # | 2531.94 | 3.43 |

| NASDAQ # | 6422.67 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 07-Jan-2019 | 14.25 | EUR | ISM Non-Manufacturing PMI (Dec) | 59.6 | 60.7 |