India Rupee Steady Ahead Of MPC Outcome; Powell Speech Eyed

6 February 2019 / Morning Brief

Indian Rupee

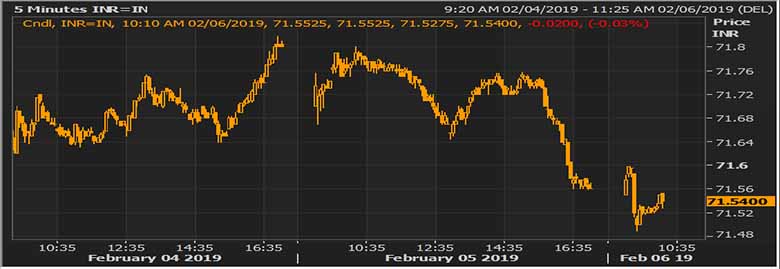

- The Indian rupee little changed at 71.55 pair now at 71.52 against 71.56 previous close.

- Pair to tip in 71.40-71.70 range today.

- The Indian rupee was little changed against the dollar in early trade, as investors awaited monetary policy decision at home and a speech from the Federal Reserve Chairman Jerome Powell, both due tomorrow. Rupee is seen consolidating at the current level amid lack of triggers today. A dovish RBI will aid rupee’s gains as rate cut is seen as growth-positive, helping equity and bond market valuation and thereby attracting capital inflows. Persistent dollar outflows post interim budget from domestic bonds is a cause of concern for the rupee, but inflows in equities has limited the impact.

Global Currency

- The dollar managed to rise although U.S. Treasury yields declined the previous day and pulled back from one-week highs. dollar is managing to draw support in spite of lower Treasury yields thanks to a combination of a dovish-sounding Federal Reserve and U.S. data, which has been relatively strong on the whole recently.

- The euro was little changed at $1.1407 EUR after slipping 0.25 percent the previous day to its lowest since Jan. 28. The single currency was pressured after a survey released on Tuesday showed euro zone businesses expanded at their weakest rate since mid-2013 at the start of the year.

Global Markets

- Oil prices edged higher for the first time in three sessions on Wednesday, although concerns over the outlook for the global economy capped gains. U.S. crude oil were at $53.74 per barrel.

- The State of the Union and what President Donald Trump tell Congress is giving a gold a bid even as the dollar retains its upward bias. Fresh concerns about the U.S. economy after a back-to-back slump in durable goods orders and services sector data boosted the yellow metal in the spot market.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.53 | 71.545 | 0.02 |

| EUR/USD | 1.14 | 81.54 | -0.07 |

| GBP/USD | 1.2955 | 92.67 | 0.03 |

| USD/JPY | 109.806 | 0.65 | 0.16 |

| SEK/INR | 9.1202 | 7.8430 | -0.0009 |

| DKK/INR | 6.3852 | 11.2025 | 0.0325 |

| AUD/USD | 1.3978 | -0.09 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.51313 | -0.42229 | |

| 3M | 2.73438 | -0.33943 | |

| 6M | 2.79575 | -0.29629 | 1Y | 2.98013 | -0.16814 |

| Index | Today | % Change |

| NIFTY | 11012.9 | 0.72 |

| SENSEX | 36871.2 | 0.69 |

| BANK NIFTY | 27376.3 | 0.38 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 20844.45 | -0.19 |

| HANG SENG | 27990.21 | 0.21 |

| SHANGHAI | 2618.2323 | 1.3 |

| ASX200 | 6033.7 | 0.46 |

| DOW JONES | 25411.52 | 0.68 |

| S&P500 # | 2737.7 | 0.47 |

| NASDAQ # | 7023.521 | 0.91 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 6-Feb-2019 | 14.30 | INR | Interest Rate Decision | 6.50% | 6.50% |

| 6-Feb-2019 | 19.00 | USD | Building Permits | 1.290M | 1.328M |

| 6-Feb-2019 | Tentative | USD | Core Durable Goods Orders (MoM) | 0.2% | -0.3% |

| 6-Feb-2019 | 19.00 | USD | Core Retail Sales (MoM) | 0.0% | 0.2% |

| 6-Feb-2019 | Tentative | USD | GDP (QoQ) | 2.6% | 3.4% |