India Rupee Up On Better Global Risk Appetite; MPC In Focus

5 February 2019 / Morning Brief

Indian Rupee

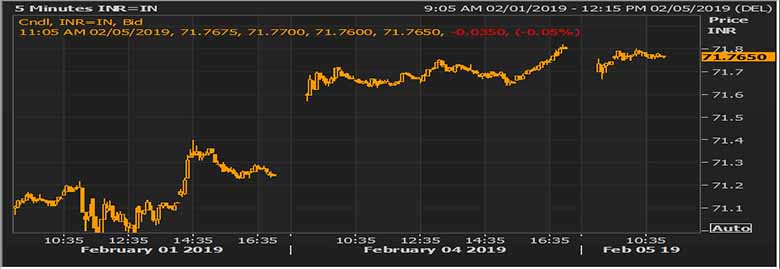

- The Indian rupee little changed at 71.70 pair now at 71.77 against 71.80 previous close.

- Pair to tip in 71.60-72.00 range today.

- The Indian rupee was slightly higher against the dollar in early trade, as overnight strength in Wall Street underpinned investors’ appetite for risk assets. Risk-off rally in global markets has helped small gains in the rupee. However, fundamentals still remain weak for the local unit and these gains are unlikely to sustain. Trading volume is expected to remain thin as most Asian markets remain shut. A large state-run lender bought dollars likely on behalf of importers, while foreign banks are on offer.

Global Currency

- Sterling was basically flat at $1.3038 GBP=D4 after seesawing during the previous session on uncertainty over the way Britain will leave the European Union. In late Monday trade, sterling gave up gains made earlier in the day after a newspaper report said that goods shipped to Britain from the European Union could be waved through without checks in the event of a "no-deal" Brexit.

- The dollar held on to recent gains against its peers on Tuesday, supported by a recovery in investor risk appetite, which gave an overnight boost to U.S. yields, while the Australian dollar dipped on dismal retail sales data.

Global Markets

- U.S. oil prices inched up on Tuesday, buoyed by expectations of tightening global supply amid U.S. sanctions on Venezuela and production cuts led by OPEC. U.S. crude oil were at $54.73 per barrel, up 16 cents from their last settlement. They closed down 1.3 % on Monday, after earlier touching their highest since Nov.

- Gold is mildly bid in Asia, but gains could be transient if the 10-year US treasury yield rises for the third straight day. Friday's stellar nonfarm payrolls number signaled that recession fears are likely overdone. Gold is reporting moderate gains in Asia.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.77 | 71.78 | 0.13 |

| EUR/USD | 1.14331 | 82.05 | 0.07 |

| GBP/USD | 1.30376 | 93.57 | 0.15 |

| USD/JPY | 109.864 | 0.65 | 0.14 |

| SEK/INR | 9.1082 | 7.8797 | 0.0073 |

| DKK/INR | 6.4066 | 11.2025 | 0.0325 |

| AUD/USD | 1.3765 | 0.2 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.514 | -0.42014 | |

| 3M | 2.73263 | -0.34186 | |

| 6M | 2.79 | -0.29629 | 1Y | 2.96163 | -0.16771 |

| Index | Today | % Change |

| NIFTY | 10919.2 | 0.06 |

| SENSEX | 36609.82 | 0.07 |

| BANK NIFTY | 27233.8 | 0.17 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 20883.77 | 0.46 |

| HANG SENG | 27990.21 | 0.21 |

| SHANGHAI | 2618.2323 | 1.3 |

| ASX200 | 6005.9 | 1.95 |

| DOW JONES | 25239.37 | 0.7 |

| S&P500 # | 2724.87 | 0.68 |

| NASDAQ # | 6959.957 | 1.23 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 5-Feb-2019 | 15.00 | GBP | Services PMI (Jan) | 51.1 | 51.2 |

| 5-Feb-2019 | 20.30 | USD | ISM Non-Manufacturing PMI (Jan) | 57.0 | 58.0 |