USD/INR Slips As Weak US Data Raises Odds Of Fed Pause In 1Q

4 January 2019 / Morning Brief

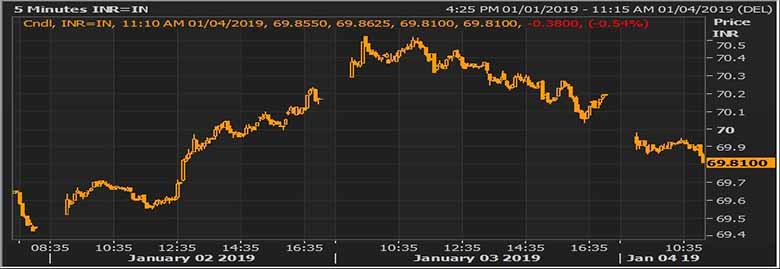

Indian Rupee

- The Indian rupee little changed at 69.96 pair now at 69.92 against 70.19 previous close.

- Pair to tip in 69.75- 70.10 range today.

- USD/INR opens lower after key US manufacturing index declines to two‐year low, prompting broad decline in dollar. Dollar index fell 0.5% yesterday and 10‐year US yield fell to near one‐year lows after ISM Manufacturing Index fell. ING says ISM survey offers further evidence that pace of Fed rate hikes will be much more modest this year. “Indeed, it is consistent with our view that the Fed will probably pause its policy tightening in Q1,” it adds. US nonfarm payroll data later today. “The ideal scenario for rupee would be that slowdown fears leads investors to price out further Fed hikes.

Global Currency

- The safe‐haven yen weakened versus the dollar on Friday on hopes upcoming U.S.‐China trade talks would make some progress, but broader market confidence remained weak amid worries over slowing global growth.

- A dovish Fed would likely keep the greenback under pressure in the coming months, giving central banks in emerging markets room to cut rates if economic conditions sharply deteriorate. "A weaker dollar should benefit emerging market currencies, but for now they are hamstrung by all the uncertainty around China,".

Global Markets

- Oil prices steadied on Friday after China said it would hold talks with Washington on Jan. 7‐8 aimed at solving trade disputes between the two world's biggest economies. Crude prices had previously fallen after the United States followed most other major economies into a manufacturing downturn.

- Gold prices hit their highest in 6‐1/2 months on Friday as volatile equity markets on the back of weak U.S. data heightened fears of a global economic slowdown, propelling the safe-haven metal towards a potential third straight weekly gain.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 69.96 | 69.8375 | -0.51 |

| EUR/USD | 1.13916 | 79.54 | -0.55 |

| GBP/USD | 1.26328 | 88.21 | -0.50 |

| USD/JPY | 108.216 | 0.64 | -1.08 |

| SEK/INR | 9.0034 | 7.7560 | -0.0397 |

| DKK/INR | 6.2334 | 11.2025 | 0.0325 |

| AUD/USD | 1.4244 | 49.01 | -0.54 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.50713 | -0.412 | |

| 3M | 2.79388 | -0.34557 | |

| 6M | 2.87394 | -0.30386 | 1Y | 3.002 | -0.18214 |

| Index | Today | % Change |

| NIFTY | 10681.3 | 0.08 |

| SENSEX | 35551.73 | 0.11 |

| BANK NIFTY | 27063.4 | 0.38 |

| SGX NIFTY | 10245 | 0.33 |

| NIKKEI | 20014.77 | -0.31 |

| HANG SENG | 25452.11 | 1.55 |

| SHANGHAI | 2503.5371 | 1.59 |

| ASX200 | 5619.4 | -0.25 |

| DOW JONES | 22686.22 | -2.83 |

| S&P500 # | 2447.89 | -2.48 |

| NASDAQ # | 6147.128 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 04-Jan-2019 | 14.25 | EUR | German Unemployment Change (Dec) | -12K | -16K |

| 04-Jan-2019 | 15.00 | GBP | Services PMI (Dec) | 50.7 | 50.4 |

| 04-Jan-2019 | 15.30 | EUR | CPI (YoY) (Dec) | 1.8% | 1.9% |

| 04-Jan-2019 | 19.00 | USD | Nonfarm Payrolls (Dec) | 178K | 155K |

| 04-Jan-2019 | 21.30 | USD | Crude Oil Inventories | -3.086M | -0.046M |