India Rupee Logs 3rd Weekly Rise As Weak Data Dents Dollar

4 January 2019 / Evening Brief

Indian Rupee

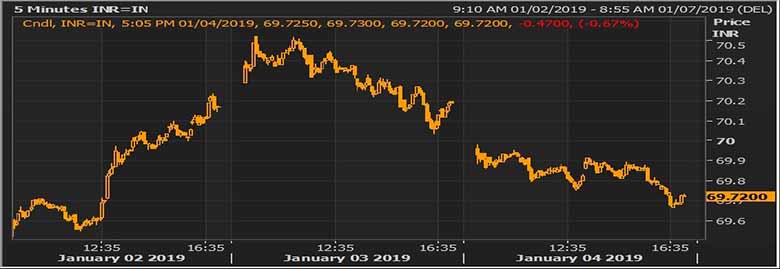

- The rupee settled at 69.72 against 70.19 at the previous close. The local unit moved in 69.6750-69.98 per dollar band intra‐day.

- The Indian rupee rose for a third straight week against the dollar, as weak U.S. manufacturing data added to global growth worries and reduced expectation of more interest rate hikes by the Federal Reserve. Some weakness in the dollar on expectation of a dovish Fed going ahead and rebound in domestic equities supported gains in the rupee. However, trajectory for the local unit may not be smooth as there are concerns lingering over global growth slowdown and trade war worries. Renewed fears on India’s fiscal deficit on likely populist measures are also likely to weigh on the rupee. Markets await key non‐farm payroll data and Fed chief Powell’s discussion on rate hike.

Global Currency

- The euro was slightly higher on Friday, despite lower than expected inflation data. Eurozone consumer prices rose at a slower‐thanexpected pace in December, increasing expectations that the European Central Bank will keep interest rates unchanged. The numbers came just after ECB policymaker Benoit Coeure said that interest rates in the EU are likely to remain at low levels until the target 2% is reached.

- Sterling was higher as the services sector accelerated in December. Still, the economy is losing momentum ahead of the UK’s departure from the European Union.

Global Markets

- Oil rose to around $57 a barrel on Friday after China said it would hold trade talks with the United States and a survey showed China's services sector expanded in December, while signs of lower crude supply also lent support.

- Gold discounts in India widened to a two‐month high this week as prices surged to a more than six‐month peak and demand remained subdued due to New Year holidays.

Global Markets at one Glance

| Markets at 5.00pm | In INR | % Change | |

| USD/INR | 69.72 | 69.73 | -0.74 |

| EUR/USD | 1.141 | 79.53 | -0.57 |

| GBP/USD | 1.26714 | 88.26 | -0.44 |

| USD/JPY | 107.99 | 0.65 | -1.01 |

| SEK/INR | 8.9872 | 7.7588 | -0.0369 |

| DKK/INR | 6.212 | 11.2250 | 0.49 |

| AUD/USD | 1.4191 | 49.08 | -0.41 |

| DXY | 96.169 | -0.14 | |

| Index | Today | % Change |

| NIFTY | 10727.35 | 0.52 |

| SENSEX | 35695.1 | 0.51 |

| NIKKEI | 19561.96 | -2.26 |

| HANG SENG | 25626.03 | 2.24 |

| SHANGHAI | 2514.8682 | 2.05 |

| CAC# | 4670.54 | 1.28 |

| FTSE # | 7264.61 | 0.0042 |

| DAX # | 10601.67 | 1.78 |

| Commodities | Today | % Change |

| GOLD # | 1291.41 | -0.17 |

| SILVER# | 15.69 | -0.1 |

| BRENT # | 57.23 | 2.29 | NYMEX # | 48.14 | 2.23 |

| Today | Today |

| OPEN | 69.9600 |

| HIGH | 69.9800 |

| LOW | 69.6750 |

| CLOSE | 70.1900 |

Key Events of the Day

| Date | Time | Currency | Event | Actual | Forecast | Previous |

| 04-Jan-19 | 14.25 | EUR | German Unemployment Change (Dec) | -14K | -12K | -16K |

| 04-Jan-19 | 15.00 | GBP | Services PMI (Dec) | 51.2 | 50.7 | 50.4 |

| 04-Jan-19 | 15.30 | EUR | CPI (YoY) (Dec) | 1.6% | 1.8% | 1.9% |