India Rupee At 7-Week Low As Upbeat U.S. Data Lifts Dollar

4 February 2019 / Morning Brief

Indian Rupee

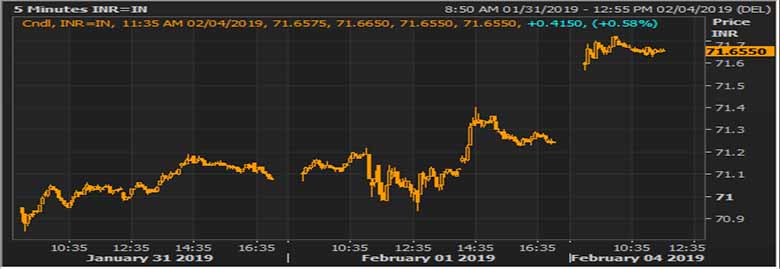

- The Indian rupee little changed at 71.60 pair now at 71.66 against 71.24 previous close.

- Pair to tip in 71.40-71.90 range today.

- The Indian rupee slipped to a seven-week low against the dollar in early trade, after U.S. employers added more jobs in January than expected and manufacturing activity in the world’s largest economy rebounded, boosting dollar demand. The rupee, which was weighed down by fiscal pressure in the budget, was further pressured by robust U.S. jobs and manufacturing data. expectation of dollar inflows in wake of recent mergers and acquisitions will likely support the rupee. However, the bias remains on the downside.

Global Currency

- Sterling GBP= was flat at $1.3083 in early Asian trade. Traders expect the British pound to remain volatile as Brexit uncertainty remains high. The Bank of England is scheduled to meet later this week and widely expected to keep interest rates steady.

- The dollar hovered near a one-week high against the yen on Monday, buoyed by stronger-than-expected U.S. jobs and factory data, although the Federal Reserve's cautious policy outlook and thinned holiday trade in Asia are likely to cap further gains. Data on Friday showed that the U.S. economy created 304,000 jobs in January, the highest in 11 months, and above street estimates. dollar was marginally higher versus the yen JPY following its largest percentage gain in almost a month during Friday's U.S. session.

Global Markets

- Oil prices prices were stable on Monday, largely maintaining gains from the previous session as OPEC-led supply cuts and U.S. sanctions against Venezuela provided the market with support.

- Gold prices slipped on Monday as risk aversion waned with the progress in U.S.-China trade talks, while a firm dollar kept the bullion under pressure. Spot gold was down 0.4 percent to $1,312.56 per ounce.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.655 | 71.6675 | 0.29 |

| EUR/USD | 1.14429 | 81.99 | 0.18 |

| GBP/USD | 1.30731 | 93.66 | 0.29 |

| USD/JPY | 109.744 | 0.65 | 0.06 |

| SEK/INR | 9.0625 | 7.9068 | 0.0262 |

| DKK/INR | 6.3963 | 11.2025 | 0.0325 |

| AUD/USD | 1.3824 | 0.17 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.514 | -0.42014 | |

| 3M | 2.73263 | -0.34186 | |

| 6M | 2.79 | -0.29629 | 1Y | 2.96163 | -0.16771 |

| Index | Today | % Change |

| NIFTY | 10840.75 | -0.49 |

| SENSEX | 36305.04 | -0.45 |

| BANK NIFTY | 26901.75 | -0.68 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 20788.39 | 0.07 |

| HANG SENG | 27990.21 | 0.21 |

| SHANGHAI | 2618.2323 | 1.3 |

| ASX200 | 5891.2 | 0.48 |

| DOW JONES | 25063.89 | 0.26 |

| S&P500 # | 2706.53 | 0.09 |

| NASDAQ # | 6875.518 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 4-Feb-2019 | 14.25 | EUR | German Manufacturing PMI (Jan) | 49.9 | 49.9 |