India Rupee Jumps On Fed Remarks; Interim Budget In Focus

31 January 2019 / Morning Brief

Indian Rupee

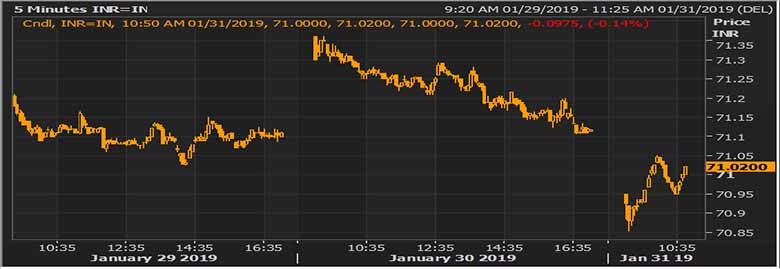

- The Indian rupee little changed at 70.95 pair now at 71.28 against 71.1175 previous close.

- Pair to tip in 70.80-71.20 range today.

- The Indian rupee rose to an over two-week high against the dollar in early trade, after the Federal Reserve said it will be “patient” on further rate increases and hinted at a likely end to its monetary policy tightening drive. Federal Reserve’s dovish policy has dented demand for the dollar against most emerging market currencies. Though rupee continues to be Asia’s worst performing currency in the region for the month, we expect some relief post the announcement of the budget. If the government retains fiscal gap inside 3.5% mark for the current financial year and remains on the fiscal consolidation path, it will lead to a rally in the rupee.

Global Currency

- The dollar fell versus its peers on Thursday after the Federal Reserve took a dovish turn at its latest policy meeting, a shift that stoked broader investor sentiment and supported currencies such as the Australian dollar and the euro.

- As it held interest rates steady, the U.S. central bank discarded its promises of "further gradual increases" in interest rates, and said it would be "patient" before making any further moves. Fed has went as far as expectations were raised in terms of being dovish..the responsive reaction by the Fed means that the chances of a recession have faded.

Global Markets

- Oil prices rose for a third day on Thursday, pushed up by lower imports into the United States amid OPEC efforts to tighten the market, and as Venezuela struggles to keep up its crude exports after Washington imposed sanctions on the nation.

- India's gold demand could rebound in 2019, rising above the 10-year average, as the government seeks to bolster consumer confidence and spending power ahead of general elections due by May.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 70.9925 | 70.9975 | -0.32 |

| EUR/USD | 1.15046 | 81.67 | -0.11 |

| GBP/USD | 1.31256 | 93.18 | -0.22 |

| USD/JPY | 108.801 | 0.65 | -0.09 |

| SEK/INR | 9.0223 | 7.8686 | -0.0049 |

| DKK/INR | 6.3372 | 11.2025 | 0.0325 |

| AUD/USD | 1.3759 | -0.32 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.49888 | -0.41686 | |

| 3M | 2.74438 | -0.33729 | |

| 6M | 2.82338 | -0.29243 | 1Y | 3.02375 | -0.17043 |

| Index | Today | % Change |

| NIFTY | 10701.05 | 0.46 |

| SENSEX | 35818.19 | 0.64 |

| BANK NIFTY | 26942.35 | 0.44 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 20556.54 | -0.52 |

| HANG SENG | 27977.33 | 1.21 |

| SHANGHAI | 2591.842 | 0.63 |

| ASX200 | 5864.7 | -0.37 |

| DOW JONES | 25014.86 | 1.77 |

| S&P500 # | 2681.05 | 1.55 |

| NASDAQ # | 6807.909 | 2.64 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 31-Jan-2019 | 14.25 | EUR | German Unemployment Change (Jan) | -11K | -14K |

| 31-Jan-2019 | 20.30 | USD | New Home Sales (Nov) | 560K | 544K |