India Rupee At 1-Week Low On Offshore Demand, Higher Oil Prices

30 January 2019 / Morning Brief

Indian Rupee

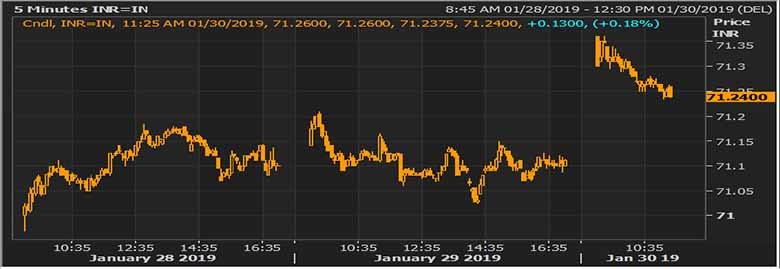

- The Indian rupee little changed at 71.36 pair now at 71.28 against 71.11 previous close.

- Pair to tip in 71.15-71.50 range today.

- The Indian rupee fell to one-week low against the U.S. currency in early trade, amid dollar demand in the offshore markets and as crude oil prices surged. The underperformance on the rupee is largely on the back of uptick in NDF markets in an overnight trade. Surge in crude oil prices and caution ahead of budget weighed on the rupee. The Federal Reserve monetary policy is closely watched for further cues.

Global Currency

- The U.S. dollar edged down on Wednesday in Asia as investors await the Federal Reserve's interest rate decision due later in the day. Put simply, the bulls look to have regained control ahead of the FOMC rate decision. The US central bank is widely expected to keep rates unchanged. The rupee could also come under pressure if the Indian government gives a populist budget on Friday.

- The pound tried to find its footing on Wednesday after sliding on fresh concerns about the possibility of a "no-deal" Brexit, while the dollar eased ahead of the Federal Reserve's policy decision. It is difficult to tell what's next for the pound. But the March 29 Brexit deadline will likely be extended, and the focal point is on when and how such an extension is decided upon.

Global Markets

- Oil prices rose on Wednesday as concerns about supply disruptions following U.S. sanctions on Venezuela's oil industry outweighed downward pressure from a darkening outlook for the global economy.

- Gold prices edged up on Wednesday to hit their highest since May, supported by uncertainty over U.S.-China trade relations and expectations the U.S. Federal Reserve will keep rates on hold later in the day.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.23 | 71.235 | -0.25 |

| EUR/USD | 1.14449 | 81.52 | -0.2 |

| GBP/USD | 1.30954 | 93.27 | -0.10 |

| USD/JPY | 109.274 | 0.65 | -0.22 |

| SEK/INR | 9.0575 | 7.8642 | -0.0134 |

| DKK/INR | 6.3584 | 11.2025 | 0.0325 |

| AUD/USD | 1.3889 | 51.28 | -0.14 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.50175 | -0.41757 | |

| 3M | 2.7505 | -0.33543 | |

| 6M | 2.82988 | -0.28771 | 1Y | 3.03 | -0.168 |

| Index | Today | % Change |

| NIFTY | 10632.6 | -0.18 |

| SENSEX | 35561.78 | -0.09 |

| BANK NIFTY | 26724.95 | 0.57 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 20664.64 | 0.08 |

| HANG SENG | 27547.23 | 0.06 |

| SHANGHAI | 2586.366 | -0.3 |

| ASX200 | 5886.7 | 0.21 |

| DOW JONES | 24579.96 | 0.21 |

| S&P500 # | 2640 | -0.15 |

| NASDAQ # | 6632.792 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 30-Jan-2019 | 18.45 | USD | ADP Nonfarm Employment Change (Jan) | 170K | 271K |

| 30-Jan-2019 | 19.00 | USD | GDP (QoQ) (Q4) | 2.6% | 3.4% |

| 30-Jan-2019 | 20.30 | USD | Pending Home Sales (MoM) (Dec) | 1.1% | -0.7% |

| 30-Jan-2019 | 21.00 | USD | Crude Oil Inventories | 7.970M | |