Indian Rupee Up On Import Duty Hike, Fed Policy Meets Expectations

27 September 2018 / Morning Brief

Indian Rupee

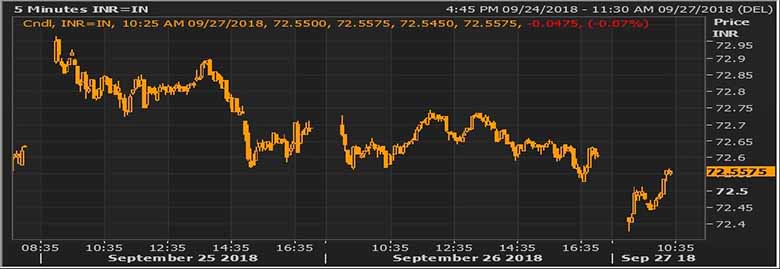

- The Indian rupee little changed at 72.42 pair now at 72.56 against 72.6050 previous close.

- Pair to tip in 72.30- 72.80 range today.

- The Indian rupee rose against the dollar in early trade, after New Delhi raised import duties on ‘non-essential items’ in a bid to control current account deficit, while the Federal Reserve’s monetary policy was in line with expectations. The impact from import curbs is expected to be limited unless we see dollar inflows coming back to the domestic markets. The response of dollar index to the Fed policy was ineffective.

Global Currency

- The dollar steadied against its peers on Thursday as a brief boost from the latest U.S. Federal Reserve interest rate hike faded, with lower U.S. Treasury yields reducing support for the dollar. The dollar index against a basket of six major currencies .DXY inched up 0.1 percent to 94.293, adding to modest gains made overnight. The Fed raised interest rates for the third time this year on Wednesday. The Fed meeting did not provide strong direction for currencies.

- The euro was up 0.05 percent at $1.1749 EUR= after declining 0.2 percent the previous day. The pound was little changed at $1.3172 GBP=D4 following a 0.1 percent dip overnight.

Global Markets

- Oil prices rose by 1 percent on Thursday as investors focused on the prospect of tighter markets due to U.S. sanctions against major crude exporter Iran, which are set to be implemented in November. Oil markets were tightening ahead of Washington's planned sanctions on Iran's petroleum industry from Nov. 4.

- Gold prices edged up early on Thursday, supported as investors looked for bargains after the metal fell to a two-week low in the previous session following a U.S. interest rate hike. Spot gold had risen 0.2 percent to $1,196.21 an ounce.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 72.545 | 72.55 | 0.17 |

| EUR/USD | 1.17486 | 85.22 | 0.22 |

| GBP/USD | 1.31508 | 95.40 | 0.09 |

| USD/JPY | 112.72 | 0.64 | 0.12 |

| SEK/INR | 8.7997 | 8.2440 | 0.0197 |

| DKK/INR | 6.3492 | 11.43 | 0.0267 |

| AUD/USD | 1.375 | 52.65 | 0.01 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.23006 | -0.40314 | |

| 3M | 2.381 | -0.352 | |

| 6M | 2.59538 | -0.314 | 1Y | 2.91188 | -0.21629 |

| Index | Today | % Change |

| NIFTY | 11047.55 | -0.06 |

| SENSEX | 36536.81 | -0.01 |

| BANK NIFTY | 25350.45 | -0.1 |

| SGX NIFTY | 11184 | 0.16 |

| NIKKEI | 24033.79 | 0.39 |

| HANG SENG | 27693 | -0.45 |

| SHANGHAI | 2795.7922 | -0.39 |

| ASX200 | 6192.2 | 0 |

| DOW JONES | 26385.28 | -0.4 |

| S&P500 # | 2905.97 | -0.33 |

| NASDAQ # | 7563.086 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 27-09-2018 | 18.00 | USD | Core Durable Goods Orders (MoM) (Aug) | 0.4% | 0.1% |

| 27-09-2018 | 18.00 | USD | GDP (QoQ) (Q2) | 4.2% | 4.2% |

| 27-09-2018 | 19.30 | USD | Pending Home Sales (MoM) (Aug) | 0.2% | 0.7% |