Indian Rupee Lower On Global Equity Rout; Weak Oil Curbs Fall

25 October 2018 / Morning Brief

Indian Rupee

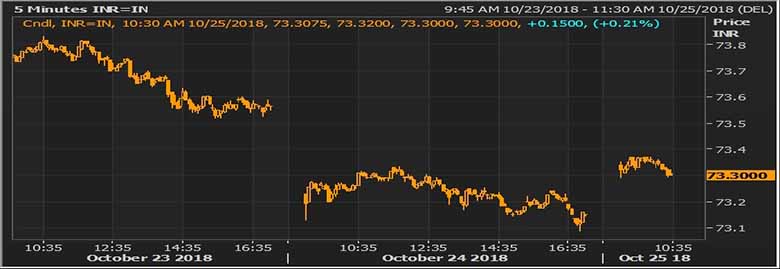

- The Indian rupee little changed at 73.34 pair now at 73.30 against 73.15 previous close.

- Pair to tip in 73.20- 73.50 range today.

- The Indian rupee fell against the dollar in early trade, tracking a sell-off in regional and local shares led by the overnight rout in Wall Street, which hurt investors’ appetite for risk assets. However, slump in crude oil prices limited further decline in the local unit. Sell-off in global equities is weighing on the rupee, which would have otherwise been strengthening tracking decline in crude oil prices.

Global Currency

- The Japanese yen rose against the dollar on Thursday as a rout on Wall Street and weak European and U.S. economic data dented global risk sentiment, sending investors scurrying to safe-haven assets including government bonds. The yen seen as a safety-bet during times of market turmoil and economic stress, advanced 0.35 percent at 111.87 on the dollar.

- The euro EUR= staged a small relief rally to trade at $1.1407, after giving up almost 0.7 percent on Wednesday - its steepest fall in percentage terms since Sept. 27, on concerns over the pace of economic growth in Europe. Euro has limited upside given risk factors such as the Italian budget, Brexit and more recently the softening economic activity.

Global Markets

- Oil prices rose modestly on Wednesday, rebounding after several days of weakness as a much bigger-than-expected drawdown in U.S. gasoline and diesel inventories augured a seasonal increase in refining demand. On Tuesday, oil prices slumped 5 percent on concerns about a weaker economic outlook.

- Gold fell on Wednesday, as a rising dollar spurred investors to take profits after tumbling stocks pushed the metal to a more than three-month peak in the previous session.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 73.29 | 73.2975 | 0.1 |

| EUR/USD | 1.14093 | 83.63 | 0.18 |

| GBP/USD | 1.28876 | 94.46 | 0.15 |

| USD/JPY | 112.105 | 0.65 | 0.14 |

| SEK/INR | 8.9941 | 8.1487 | 0.0191 |

| DKK/INR | 6.5396 | 11.21 | 0.0212 |

| AUD/USD | 1.4128 | 51.87 | 0.28 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.28138 | -0.40957 | |

| 3M | 2.48988 | -0.35271 | |

| 6M | 2.74756 | -0.32443 | 1Y | 3.03438 | -0.20543 |

| Index | Today | % Change |

| NIFTY | 10133.85 | -0.89 |

| SENSEX | 33722.5 | -0.92 |

| BANK NIFTY | 24912.25 | -0.61 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 22091.18 | 0.37 |

| HANG SENG | 24794.6 | -1.8 |

| SHANGHAI | 2566.2061 | -1.42 |

| ASX200 | 5681.8 | -2.53 |

| DOW JONES | 24583.42 | -2.41 |

| S&P500 # | 2656.1 | -3.09 |

| NASDAQ # | 6789.154 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 25-10-2018 | 13.30 | EUR | German Ifo Business Climate Index | 103.1 | 103.7 |

| 25-10-2018 | 17.15 | EUR | ECB Marginal Lending Facility | 0.25% | 0.25% |

| 25-10-2018 | 17.15 | EUR | ECB Interest Rate Decision (Oct) | 0.00% | 0.00% |

| 25-10-2018 | 18.00 | USD | Core Durable Goods Orders (MoM) (Sep) | 0.5% | 0.1% |

| 25-10-2018 | 19.30 | USD | Pending Home Sales (MoM) (Sep) | -0.1% | -1.8% |