USD/INR Lower As Oil Extends Losses; Shares, ECB Eyed

24 January 2019 / Morning Brief

Indian Rupee

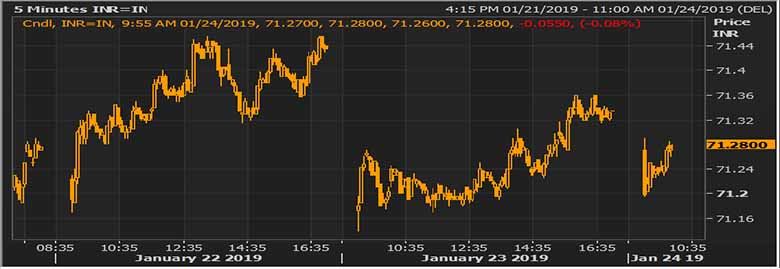

- The Indian rupee little changed at 71.27 pair now at 71.28 against 71.3350 previous close.

- Pair to tip in 71.10-71.50 range today.

- The Indian rupee rose against the dollar in early trade, in line with most Asian currencies amid broad weakness in the dollar and as oil prices extended fall to the third straight session. Broad weakness in the dollar and lower oil prices lifted the rupee in opening trade. However, these gains are unlikely to sustain as fiscal woes continue to hurt local assets. The crude oil prices fell on concerns over global growth and an unexpected increase in U.S. inventories. Flows remain in favor of the dollar with importer buy orders at dips and short term foreign portfolio flows negative.

Global Currency

- The dollar was hamstrung versus its rivals on Thursday, restrained by concerns over global growth, the U.S. government shutdown and a yet-unresolved U.S.-Sino trade dispute. Trade tensions are the most dominant factor for investor sentiment right now and will drive market flows

- All eyes will be on the euro as investors await the European Central Bank's monetary policy announcement later on Thursday where it is all but certain to keep policy unchanged. The single currency was marginally higher at $1.1383. The euro has lost around 1.6 percent of its value over the last two weeks as traders expect the ECB to remain dovish and keep monetary policy accommodative.

Global Markets

- Oil prices slipped on Wednesday as the European Union seeks to circumvent U.S. trade sanctions against Iran, and on weaker U.S. gasoline prices.

- Gold prices steadied on Wednesday, clawing back from losses made earlier in the session, as a recovery in stock markets fizzled out on concerns over geopolitical and economic uncertainty, triggering investors to seek safety in the metal.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.285 | 71.29 | 0.21 |

| EUR/USD | 1.13895 | 81.18 | 0.22 |

| GBP/USD | 1.30744 | 93.20 | 0.22 |

| USD/JPY | 109.517 | 0.65 | 0.24 |

| SEK/INR | 9.0134 | 7.9088 | 0.0166 |

| DKK/INR | 6.3633 | 11.2025 | 0.0325 |

| AUD/USD | 1.4052 | 50.71 | 0.17 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.519 | -0.41986 | |

| 3M | 2.77925 | -0.33271 | |

| 6M | 2.85363 | -0.29357 | 1Y | 3.03713 | -0.17314 |

| Index | Today | % Change |

| NIFTY | 10817.7 | -0.13 |

| SENSEX | 36059.45 | -0.14 |

| BANK NIFTY | 27218.4 | -0.12 |

| SGX NIFTY | 10834 | 0.01 |

| NIKKEI | 20593.72 | -0.14 |

| HANG SENG | 27045.06 | 0.14 |

| SHANGHAI | 2594.1762 | 0.51 |

| ASX200 | 5859.7 | 0.27 |

| DOW JONES | 24575.62 | 0.7 |

| S&P500 # | 2638.7 | 0.22 |

| NASDAQ # | 6658.763 | 0.18 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 24-01-2019 | 14.00 | EUR | German Manufacturing PMI (Jan) | 51.3 | 51.5 |

| 24-01-2019 | 18.15 | EUR | Deposit Facility Rate | -0.40% | -0.40% |

| 24-01-2019 | 18.15 | EUR | ECB Marginal Lending Facility | 0.25% | 0.25% |

| 24-01-2019 | 18.15 | EUR | ECB Interest Rate Decision (Jan) | 0.00% | 0.00% |