India Rupee Slips For 3rd Day On Risk Aversion

22 January 2019 / Evening Brief

Indian Rupee

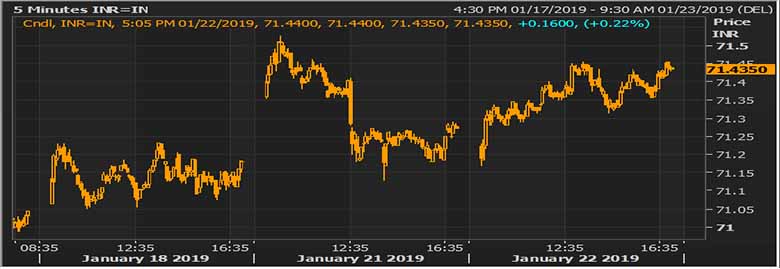

- The rupee settled at 71.4350 against 71.2750 at the previous close. The local unit moved in 71.18-71.4550 per dollar band intra-day.

- The Indian rupee slipped for a third straight session against the dollar, as muted investors’ appetite for risk assets increased demand for the greenback, outweighing impact of lower crude oil prices. We expect some more downside on the rupee on technical basis. Rise in crude prices in last few sessions and shares consolidating as the overall global growth outlook remain subdued, has weighed on the rupee despite domestic factors being comfortable, There might be some uncertainty ahead of general elections, we may see some fiscal slippages.

Global Currency

- The dollar held at a near three-week high on Tuesday as investors sought the relative safety of the U.S. currency after the International Monetary Fund cut its forecasts for the world economy in 2019 and 2020. The dollar has been considered a consensus short trade since the end of 2018 on concerns that the U.S. Federal Reserve will pause in its interest rate increases. But it has been boosted in recent days by lack of growth in other regions, notably Europe.

- Sterling was holding steady with GBP/USD at 1.2889 amid ongoing uncertainty over Brexit. On Monday, British Prime Minister Theresa May put forward a motion on her proposed next steps, designed to break the deadlock in parliament.

Global Markets

- Oil prices fell more than 1 percent on Tuesday on signs that an economic slowdown in China was spreading, stoking concerns about global growth and fuel demand. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $53.16 per barrel, down 1.19 percent or 64 cents.

- The safe-haven gold fell on Tuesday in Asia even after the International Monetary Fund (IMF) trimmed global growth forecasts.

Global Markets at one Glance

| Markets at 5.00pm | In INR | % Change | |

| USD/INR | 71.285 | 71.285 | 0.11 |

| EUR/USD | 1.13677 | 81.05 | 0.15 |

| GBP/USD | 1.28729 | 91.70 | 0.06 |

| USD/JPY | 109.587 | 0.65 | 0.28 |

| SEK/INR | 9.0211 | 7.9020 | 0.0154 |

| DKK/INR | 6.351 | 11.2250 | 0.49 |

| AUD/USD | 1.3971 | 51.01 | -0.2 |

| DXY | 96.345 | 0.01 | |

| Index | Today | % Change |

| NIFTY | 110961.85 | 0.5 |

| SENSEX | 36578.96 | 0.53 |

| NIKKEI | 20719.33 | 0.26 |

| HANG SENG | 27196.54 | 0.39 |

| SHANGHAI | 2610.5094 | 0.56 |

| CAC# | 4869.03 | -0.14 |

| FTSE # | 7264.61 | 0.0042 |

| DAX # | 11160.68 | -0.4 |

| Commodities | Today | % Change |

| GOLD # | 1278.6 | -0.18 |

| SILVER# | 15.26 | -0.46 |

| BRENT # | 62.5 | -0.32 | NYMEX # | 53.65 | -0.28 |

| Today | Today |

| OPEN | 71.2225 |

| HIGH | 71.4550 |

| LOW | 71.1800 |

| CLOSE | 71.4350 |

Key Events of the Day

| Date | Time | Currency | Event | Actual | Forecast | Previous |

| 22-01-2019 | 15.00 | GBP | Average Earnings Index +Bonus (Nov) | 3.4% | 3.3% | 3.3% |

| 22-01-2019 | 15.00 | GBP | Claimant Count Change (Dec) | 20.8K | 20.0K | 24.8K |

| 22-01-2019 | 15.30 | eur | German ZEW Economic Sentiment (Jan) | -15.0 | -18.4 | -17.5 |