India Rupee Higher As Oil Price Eases; Stocks Watched

22 February 2019 / Morning Brief

Indian Rupee

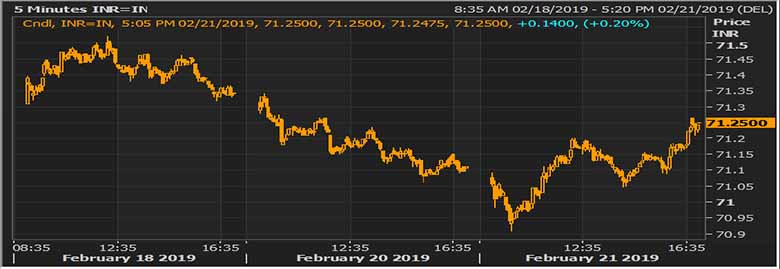

- The Indian rupee little changed at 71.25 pair now at 71.15 against 71.25 previous close.

- Pair to tip in 71.00-71.40 range today.

- The Indian rupee rose against the dollar in early trade as crude oil prices came off recent highs, aiding concerns of wider trade deficit gap at home. Some softness in crude prices is aiding the rupee. However, we believe the dollar-rupee pair will remain on bids as importers will step up dollar purchases amid broad strength in the dollar and unfavourable risk sentiments. Markets will closely track outcome from ongoing trade talks between the U.S. and China.

Global Currency

- The dollar held gains against its peers early on Friday, bolstered by a rise in U.S. yields, while the Aussie clawed back some of its recent plunge on upbeat central bank comments and easing concerns about China's ban on Australian coal imports. The rise by the greenback, however, had been limited after Thursday's soft U.S. economic data, including an unexpected fall in core capital goods orders and weak existing home sales, which affirmed expectations that the Federal Reserve will hold interest rates steady.

- Sterling has swung wildly between a low of $1.2895 and a high of $1.3109 this week as British Prime Minister Theresa May tries to persuade European Commission chief Jean-Claude Juncker to modify her withdrawal deal and then get the tweaked agreement through parliament.

Global Markets

- Oil prices fell on Friday after the United States reported its crude output hit a record 12 million barrels per day (bpd), undermining efforts by Middle East-dominated producer club OPEC to withhold supply and tighten global markets.

- Gold inched up on Friday as optimism over U.S.-China trade talks pressured the dollar, but signs the U.S. Federal Reserve could raise interest rates again this year kept prices below 10-month highs hit.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.17 | 71.18 | 0.03 |

| EUR/USD | 1.13338 | 80.66 | 0 |

| GBP/USD | 1.30278 | 92.70 | -0.04 |

| USD/JPY | 110.794 | 0.64 | -0.08 |

| SEK/INR | 9.3711 | 7.5946 | 0.0025 |

| DKK/INR | 6.3530 | 11.2025 | 0.0325 |

| AUD/USD | 1.4094 | -0.11 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.48113 | -0.40971 | |

| 3M | 2.66338 | -0.34443 | |

| 6M | 2.69338 | -0.29129 | 1Y | 2.87425 | -0.16586 |

| Index | Today | % Change |

| NIFTY | 10787.25 | -0.02 |

| SENSEX | 35891.54 | -0.02 |

| BANK NIFTY | 26951.4 | -0.37 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 21464.23 | 0.15 |

| HANG SENG | 28545.23 | -0.3 |

| SHANGHAI | 2752.732 | 0.03 |

| ASX200 | 6167.8 | 0.47 |

| DOW JONES | 25850.63 | -0.4 |

| S&P500 # | 2774.88 | -0.35 |

| NASDAQ # | 7035.164 | -0.38 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 22-Feb-19 | 12:30 | EUR | German GDP (QoQ) (Q4) | 0.0% | 0.0% |

| 22-Feb-19 | 14:30 | EUR | German Ifo Business Climate Index | 99.0 | 99.1 |

| 22-Feb-19 | 15:30 | EUR | CPI (YoY) (Jan) | 1.4% | 1.4% |