India Rupee Logs 2nd Weekly Rise As Risk Appetite Improves

22 February 2019 / Evening Brief

Indian Rupee

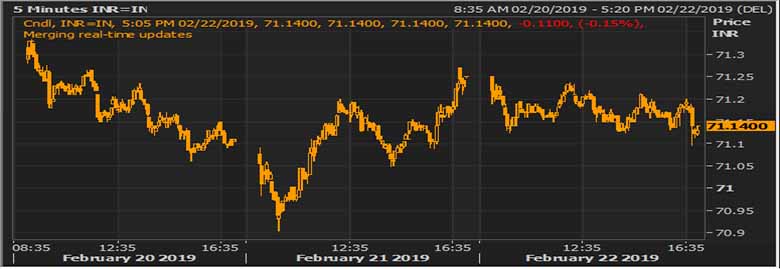

- The rupee settled at 71.14 against 71.25 at the previous close. The local unit moved in 71.10 -71.25 per dollar band intra-day.

- The Indian rupee posted a second weekly rise against the dollar, as optimism over trade talks between the U.S. and China lifted investors’ appetite for risk assets and weighed on dollar demand. Higher crude oil prices have capped appreciation in the rupee from the liquidity provided by the Federal Reserve amid upbeat risk appetite. However, we expect the upside in Brent crude prices to be limited. U.S.-China trade resolution will be temporarily positive for oil price but overall global slowdown and U.S. oil production will keep a good check on crude. At home, Indian election and geopolitics risks will keep the domestic currency under pressure.

Global Currency

- The dollar was steady and on track for its first weekly loss in a month in early trading in Europe Friday, although it had recovered most of the ground it lost Thursday in reaction to some weak numbers from the U.S. manufacturing sector.

- Sterling is in a holding pattern ahead of next week’s Brexit showdown in parliament, when MPs will again get the chance to find a course of action they can agree on. Defections by lawmakers from both of the major parties have raised the pressure on Prime Minister Theresa May and opposition leader Jeremy Corbyn to find an acceptable compromise.

Global Markets

- Gold held steady on Friday, on course for its second straight weekly gain, with weak economic data from the United States compounding worries about a global slowdown while investors await concrete signals on U.S.-China trade talks.

- Oil prices rose on Friday, supported by OPEC's ongoing supply cuts and hopes that Washington and Beijing may soon end their trade dispute. crude oil hit a new 2019 high of $67.60 a barrel.

Global Markets at one Glance

| Markets at 5.00pm | In INR | % Change | |

| USD/INR | 71.15 | 71.15 | -0.04 |

| EUR/USD | 1.13324 | 80.62 | -0.05 |

| GBP/USD | 1.2995 | 92.42 | -0.34 |

| USD/JPY | 110.876 | 0.64 | -0.18 |

| SEK/INR | 9.3602 | 7.6013 | 0.0092 |

| DKK/INR | 6.339 | 11.2250 | 0.49 |

| AUD/USD | 1.4057 | 50.60 | 0 |

| DXY | 96.651 | 0.05 | |

| Index | Today | % Change |

| NIFTY | 10791.65 | 0.02 |

| SENSEX | 35871.48 | -0.07 |

| NIKKEI | 21425.51 | -0.18 |

| HANG SENG | 28816.3 | 0.65 |

| SHANGHAI | 2804.2262 | 1.91 |

| CAC# | 5215.18 | 0.37 |

| FTSE # | 7264.61 | 0.0042 |

| DAX # | 11492.5 | 0.61 |

| Commodities | Today | % Change |

| GOLD # | 1323.95 | 0.06 |

| SILVER# | 15.791 | 0 |

| BRENT # | 67.38 | 0.46 |

| NYMEX # | 57.37 | 0.72 |

| Today | Today |

| OPEN | 71.2500 |

| HIGH | 71.2500 |

| LOW | 71.1000 |

| CLOSE | 71.1400 |

Key Events of the Day

| Date | Time | Currency | Event | Actual | Forecast | Previous |

| 22-Feb-19 | 12.30 | EUR | German GDP (QoQ) (Q4) | 0.0% | 0.0% | 0.0% |

| 22-Feb-19 | 14.30 | EUR | German Ifo Business Climate Index | 98.5 | 99.0 | 99.3 |

| 22-Feb-19 | 15.30 | EUR | CPI (YoY) (Jan) | 1.4% | 1.4% | 1.5% |