India Rupee Jumps On Likely Inflows; Oil, Fed Minutes Cap Gains

21 February 2019 / Morning Brief

Indian Rupee

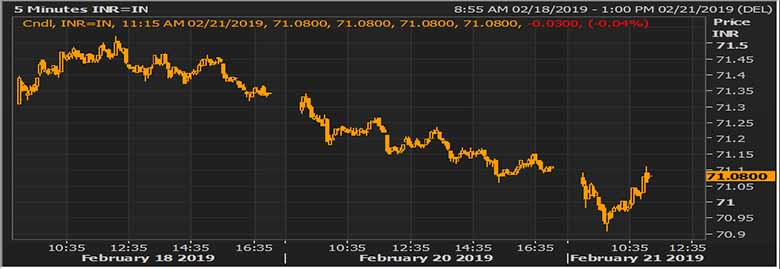

- The Indian rupee little changed at 71.0750 pair now at 71.02 against 71.11 previous close.

- Pair to tip in 71.85-71.15 range today.

- The Indian rupee rose to a one-week high against the dollar in early trade, on likely dollar inflows that outweighed rally in crude oil prices and dollar strength following minutes of the Federal Reserve’s latest meeting. Dollar inflows related to an external commercial borrowing deal lifted the rupee in early trade in an unexpected move. With the rally in crude prices continuing and mixed cues from Fed minutes on further rate hikes, further gains in the local unit will be limited.

Global Currency

- The dollar inched up on Thursday after minutes from the Federal Reserve's last meeting revived expectations for a possible U.S. rate hike this year while investors shifted their focus back to trade issues for fresh directional cues. The greenback had edged up against the yen and trimmed losses versus the euro late on Wednesday after the Fed, in the minutes of its latest meeting in January, said the U.S. economy and its labour market remained strong, prompting some expectations of at least one more interest rate hike this year.

- The pound dipped 0.1 percent to $1.3039 GBP=D3 after pulling back from a near three-week high of $1.3109 touched the previous day. Sterling took a knock after three lawmakers defected from British Prime Minister Theresa May's ruling Conservative party in a move that could undermine her Brexit strategy.

Global Markets

- Oil prices hovered close to 2019 highs on Thursday, bolstered by OPEC-led supply cuts and U.S. sanctions on Venezuela and Iran, but were prevented from rising further by slowing growth in the global economy.

- Gold prices turned negative Wednesday, but remained near multimonth highs as the dollar pared losses despite the Federal Reserve signaling it was preparing to stop trimming its balance sheet later.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.0725 | 71.0825 | 0.04 |

| EUR/USD | 1.13431 | 80.61 | 0 |

| GBP/USD | 1.3039 | 92.66 | -0.04 |

| USD/JPY | 110.785 | 0.64 | 0.13 |

| SEK/INR | 9.3091 | 7.6347 | 0.0079 |

| DKK/INR | 6.3443 | 11.2025 | 0.0325 |

| AUD/USD | 1.4059 | -0.04 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.48225 | -0.40871 | |

| 3M | 2.64125 | -0.34557 | |

| 6M | 2.73575 | -0.29086 | 1Y | 2.89113 | -0.16771 |

| Index | Today | % Change |

| NIFTY | 10745.05 | 0.09 |

| SENSEX | 35792.39 | 0.1 |

| BANK NIFTY | 27008.4 | 0.2 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 21431.49 | 0.60 |

| HANG SENG | 28725.99 | 0.74 |

| SHANGHAI | 2786.0665 | 0.9 |

| ASX200 | 6139.2 | 0.7 |

| DOW JONES | 25954.44 | 0.24 |

| S&P500 # | 2784.7 | 0.18 |

| NASDAQ # | 7062.339 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 21-Feb-19 | 14:00 | EUR | German Manufacturing PMI (Feb) | 50.0 | 49.7 |

| 21-Feb-19 | 19:00 | USD | Core Durable Goods Orders (MoM) (Dec) | 0.2% | -0.4% |

| 21-Feb-19 | 19:00 | USD | Philadelphia Fed Manufacturing Index (Feb) | 15.6 | 17.0 |

| 21-Feb-19 | 20:30 | USD | Existing Home Sales (Jan) | 5.01M | 4.99M |