Indian Rupee Lower On Corporate, Offshore Dollar Demand

21 December 2018 / Morning Brief

Indian Rupee

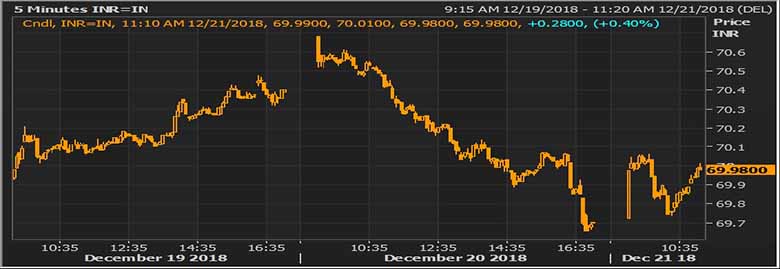

- The Indian rupee little changed at 69.7225 pair now at 69.94 against 69.70 previous close.

- Pair to tip in 69.70- 70.20 range today.

- The Indian rupee fell against the dollar in early trade amid demand for the U.S. currency from importers, which overshadowed Brent crude oil’s decline to new year‐to‐date lows. Importers will be keen to hedge on any dips on the USD/INR pair from current levels and offshore participants will be looking to take profits on their dollar shorts.

Global Currency

- The dollar has slumped after the Federal Reserve signalled fewer interest rate hikes over the next few years than it previously projected and helped push long-term U.S. Treasury yields to near nine‐month lows. The dollar hovered near a one‐month low against its peers on Friday, weighed down by a subdued outlook towards U.S. interest rates and the economy, while risk aversion in the broader markets boosted the yen.

- Sterling had climbed to a 10‐day peak of $1.2707 on Thursday but pulled back from the high after the Bank of England kept interest rates on hold, saying Brexit uncertainty had "intensified considerably" over the last month

Global Markets

- Oil prices climbed on Friday after tumbling 5 percent in the last session, with OPEC production cuts that start next month seen being deeper then previously expected. U.S. WTI crude rose 1.53 percent, or 70 cents, to $46.58 per barrel.

- Gold prices steadied on Friday, holding firm near a six‐month high struck in the previous session, as the dollar remained under pressure due to a subdued outlook towards U.S. interest rates and the economy, and investors shunned risky assets.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 69.9875 | 69.9975 | 0.04 |

| EUR/USD | 1.1445 | 80.10 | -0.02 |

| GBP/USD | 1.2649 | 88.52 | -0.04 |

| USD/JPY | 111.417 | 0.63 | -0.15 |

| SEK/INR | 8.9853 | 7.7891 | -0.0065 |

| DKK/INR | 6.2475 | 11.2250 | 0.0325 |

| AUD/USD | 1.4069 | 49.74 | -0.07 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.47938 | -0.41557 | |

| 3M | 2.78963 | -0.34986 | |

| 6M | 2.87088 | -0.31743 | 1Y | 3.05275 | -0.21486 |

| Index | Today | % Change |

| NIFTY | 10841 | -1.01 |

| SENSEX | 36092.56 | -0.93 |

| BANK NIFTY | 27100.7 | -0.64 |

| SGX NIFTY | 10850 | -0.15 |

| NIKKEI | 20392.58 | -2.84 |

| HANG SENG | 25552.25 | -0.28 |

| SHANGHAI | 2506.1637 | -1.19 |

| ASX200 | 5467.6 | -0.69 |

| DOW JONES | 22859.6 | -1.99 |

| S&P500 # | 2467.42 | -1.58 |

| NASDAQ # | 6243.195 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 21-12-2018 | 15.00 | GBP | GDP (YoY) (Q3) | 1.5% | 1.5% |

| 21-12-2018 | 15.00 | GBP | GDP (QoQ) (Q3) | 0.6% | 0.6% |

| 21-12-2018 | 19.00 | USD | Core Durable Goods Orders (MoM) (Nov) | 0.3% | 0.2% |

| 21-12-2018 | 19.00 | USD | GDP (QoQ) (Q3) | 3.5% | 3.5% |