India Rupee Lower As Shares Fall, Oil Gains; RBI Likely Steps In

15 February 2019 / Morning Brief

Indian Rupee

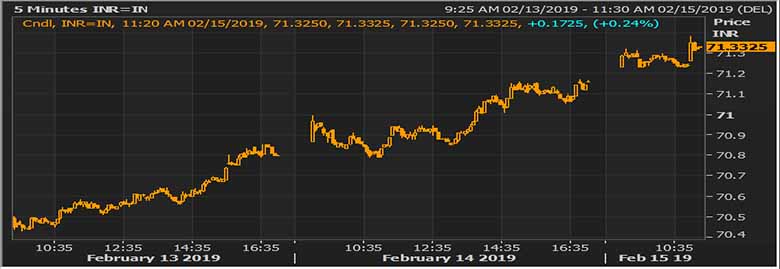

- The Indian rupee little changed at 71.23 pair now at 71.28 against 71.16 previous close.

- Pair to tip in 71.10-71.50 range today.

- The Indian rupee fell to a one-week low against the dollar in early trade, as appetite for risk assets remain muted, while Brent crude prices jumped above the $65 per barrel mark. Risk-off rally in the global markets and surge in crude prices weighed on the rupee, despite subdued dollar index amid weak U.S. retail sales data. We believe, likely dollar sales by some state-run banks and a private lender on behalf of the central bank in small quantum will slow down the pace of depreciation.

Global Currency

- The dollar edged lower versus the yen on Friday as dismal U.S. retail sales data reinforced expectations the Federal Reserve will not raise rates this year, while the market awaited developments in trade talks between Washington and Beijing. U.S. retail sales posted their largest decline since September 2009, data showed on Thursday, a sign of weakness in the consumer sector, which accounts for more than two-thirds of the economy.

- Sterling GBP= was down 0.16 percent at $1.2791. Traders expect the pound to remain volatile in the coming weeks. Sterling is set to finish the week 1.2 percent lower versus the dollar, its third straight week of losses.

Global Markets

- Oil prices rallied on Friday, with Brent crude futures hitting fresh 2019 highs amid U.S. sanctions against Venezuela and Iran and supply cuts led by the Organization of the Petroleum Exporting.

- Gold traded in a tight $3 range on Friday as concerns over an economic slowdown supported prices for the safe-haven metal and a firm dollar kept a lid on gains. gold was steady at $1,312.56 per ounce.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.32 | 71.3325 | 0.43 |

| EUR/USD | 1.12833 | 80.47 | 0.29 |

| GBP/USD | 1.27953 | 91.25 | 0.43 |

| USD/JPY | 110.34 | 0.65 | 0.56 |

| SEK/INR | 9.3041 | 7.6654 | 0.0231 |

| DKK/INR | 6.3664 | 11.2025 | 0.0325 |

| AUD/USD | 1.4105 | 0.3 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.48875 | -0.41343 | |

| 3M | 2.68375 | -0.34443 | |

| 6M | 2.74325 | -0.297 | 1Y | 2.91575 | -0.18014 |

| Index | Today | % Change |

| NIFTY | 10671.4 | -0.69 |

| SENSEX | 35670.82 | -0.57 |

| BANK NIFTY | 26797.5 | -0.64 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 21139.71 | -0.02 |

| HANG SENG | 27900.15 | -1.87 |

| SHANGHAI | 2691.5153 | -1.04 |

| ASX200 | 6066.1 | 0.11 |

| DOW JONES | 25439.39 | -0.41 |

| S&P500 # | 2745.73 | -0.27 |

| NASDAQ # | 7022.419 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 15-02-2019 | 15.00 | GBP | Retail Sales (MoM) (Jan) | 0.2% | -0.9% |

| 15-02-2019 | 19.00 | USD | Core Retail Sales (MoM) (Dec) | 0.1% | 0.2% |

| 15-02-2019 | 19.00 | USD | Retail Sales (MoM) (Dec) | 0.2% | 0.2% |