Indian Rupee Falls On Weak Asian Cues, Higher Crude Oil Prices

14 December 2018 / Morning Brief

Indian Rupee

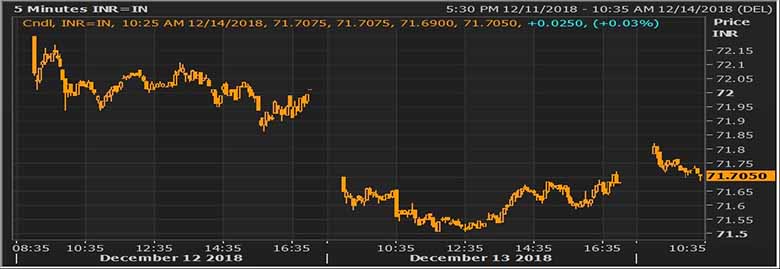

- The Indian rupee little changed at 71.7850 pair now at 71.74 against 71.68 previous close.

- Pair to tip in 71.55- 71.95 range today.

- The Indian rupee fell against dollar in early trade, tracking losses in most Asian currencies as regional shares were weighed down by weak Chinese economic data. Broad weakness in the Asian assets following weak Chinese data has spilled over to the rupee, while local investors await India’s trade deficit data. Overnight gains in crude oil prices also adding pressure.

Global Currency

- The ECB formally ended its 2.6 trillion euro crisis‐fighting bond purchase scheme on Thursday. However, monetary policy is most likely to remain accommodative as ECB president Mario Draghi warned that the euro area's growth outlook is likely to remain weak amid threats of a global trade war and the prospect of a hard Brexit.

- The dollar firmed against most major counterparts on Friday as investor focus shifted to an expected U.S. interest rate hike next week, although gains are likely to be capped on greater uncertainty about next year's policy outlook. The Fed is widely expected to raise interest rates by 25 basis points, its fourth rate hike this year though greater focus will centre on the policy outlook for 2019.

Global Markets

- Oil prices fell on Friday as investors cashed in gains of more than 2 percent made during the previous session on concerns demand may slump amid slowing economic growth, though there are still expectations for producer supply cuts to support price.

- Gold is trading in a sideways manner around the 200‐hour MA in Asia. Risk‐off in equities and a slight drop in the treasury yields is likely helping the yellow metal defend the MA support. Gold's bullish move may have lost its mojo in the last few days, beating the 200- hour MA is still proving a tough task for the bears.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.705 | 71.715 | 0.26 |

| EUR/USD | 1.13603 | 81.46 | 0.22 |

| GBP/USD | 1.26314 | 90.57 | 0.06 |

| USD/JPY | 113.451 | 0.63 | 0.38 |

| SEK/INR | 9.0675 | 7.9079 | 0.0105 |

| DKK/INR | 6.4008 | 11.2025 | 0.0325 |

| AUD/USD | 1.3899 | 0.11 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.44013 | -0.41371 | |

| 3M | 2.7775 | -0.35586 | |

| 6M | 2.89225 | -0.32429 | 1Y | 3.10125 | -0.21229 |

| Index | Today | % Change |

| NIFTY | 10800.2 | 0.08 |

| SENSEX | 35958.37 | 0.08 |

| BANK NIFTY | 26839.5 | 0.09 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 21816.19 | 0.99 |

| HANG SENG | 26159.81 | -1.37 |

| SHANGHAI | 2619.0652 | -0.57 |

| ASX200 | 5610.1 | -0.91 |

| DOW JONES | 24597.38 | 0.29 |

| S&P500 # | 2650.54 | -0.02 |

| NASDAQ # | 6767.974 | 0.06 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 14-12-2018 | 14.00 | EUR | German Manufacturing PMI (Dec) | 51.8 | 51.8 |

| 14-12-2018 | 19.00 | USD | Core Retail Sales (MoM) (Nov) | 0.2% | 0.7% |

| 14-12-2018 | 19.00 | USD | Retail Sales (MoM) (Nov) | 0.1% | 0.8% |