Indian Rupee Gains As Robust Local Economic Data Lifts Sentiment

13 December 2018 / Morning Brief

Indian Rupee

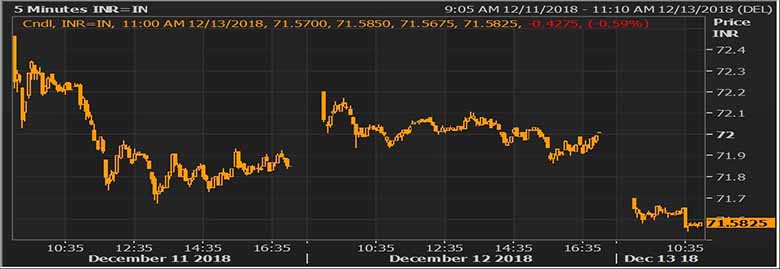

- The Indian rupee little changed at 71.71 pair now at 71.58 against 72.01 previous close.

- Pair to tip in 71.40‐ 71.80 range today.

- The Indian rupee jumped against the dollar in early trade, as slowerthan‐ expected expansion in retail inflation and industrial output at 11‐month high at home boosted demand for local assets. Upbeat economic data led to a rally in domestic bonds and equities, increasing expectations of foreign fund inflows, while globally as well the mood was positive.

Global Currency

- The euro edged higher against the dollar after Italy lowered its deficit target for next year and said it expected the European Commission to accept its new 2019 budget proposal.

- The pound largely held onto overnight gains on Thursday after British Prime Minister Theresa May pulled through a no‐confidence vote on her leadership that bought her more time to try to sell her unpopular Brexit deal to a deeply divided parliament. The euro edged higher against the dollar after Italy lowered its deficit target for next year and said it expected the European Commission to accept its new 2019 budget proposal.

Global Markets

- Oil prices rose on Thursday, buoyed by a drawdown in U.S. crude inventories and signs that China is taking more concrete steps to put a trade war truce with Washington into action. Crude oil prices have also been supported by OPEC‐led supply curbs announced last week, although gains were capped after the producer group lowered its 2019 demand forecast.

- Gold prices slipped on Thursday as the dollar steadied and equities climbed on signs of easing trade tensions between the United States and China, while palladium rose to a record high, trading at a premium to the bullion. Gold was down 0.2 percent at $1,243.91 per ounce.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.5825 | 71.59 | -0.34 |

| EUR/USD | 1.13659 | 81.35 | -0.39 |

| GBP/USD | 1.26186 | 90.33 | 0.34 |

| USD/JPY | 113.476 | 0.63 | 0.59 |

| SEK/INR | 9.0893 | 7.8755 | -0.0253 |

| DKK/INR | 6.3899 | 11.2025 | 0.0325 |

| AUD/USD | 1.3831 | -0.37 | |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.43238 | -0.41071 | |

| 3M | 2.779 | -0.35729 | |

| 6M | 2.88063 | -0.32529 | 1Y | 3.0895 | -0.21229 |

| Index | Today | % Change |

| NIFTY | 10806.25 | 0.64 |

| SENSEX | 36005.91 | 0.63 |

| BANK NIFTY | 26928 | 1.07 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 21602.75 | 2.15 |

| HANG SENG | 26487.27 | 1.15 |

| SHANGHAI | 2641.561 | 1.51 |

| ASX200 | 5661.6 | 0.14 |

| DOW JONES | 24527.27 | 0.64 |

| S&P500 # | 2651.07 | 0.54 |

| NASDAQ # | 6763.957 | 0.89 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 13/12/2018 | 18.15 | EUR | Deposit Facility Rate | -0.40% | -0.40% |

| 13/12/2018 | 18.15 | EUR | ECB Marginal Lending Facility | 0.25% | 0.25% |

| 13/12/2018 | 18.15 | EUR | ECB Interest Rate Decision (Dec) | 0.00% | 0.00% |