Indian Rupee Lower As Brent Crude Nears $83 Per Barrel

1 October 2018 / Morning Brief

Indian Rupee

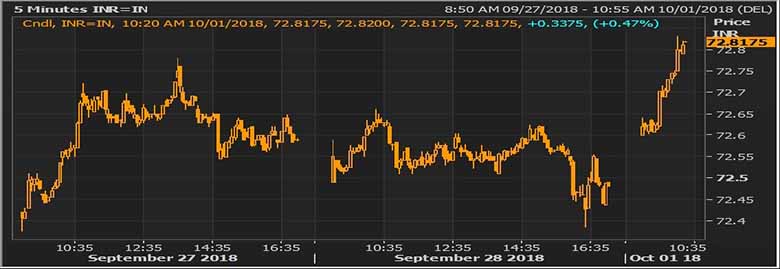

- The Indian rupee little changed at 72.60 pair now at 72.82 against 72.48 previous close.

- Pair to tip in 72.50- 72.90 range today.

- Dollar/rupee snapped two-day fall Monday tracking the surge in crude oil prices amid strong dollar as globally investors expects Fed to hike rates multiple times by 2020. Surge in crude oil prices and dollar index above 95 is pushing the spot pair upward. Also, arbitrage opportunity between spot and 1-month NDF too is supporting the demand for dollar in spot market, traders are seen buying in spot and selling in NDF.

Global Currency

- The dollar slipped against the Canadian dollar on Monday as the United States and Canada reached a framework deal to update the North American Free Trade Agreement.

- The euro EUR= was down 0.1 percent at $1.1595, with worries about a rise in Italy's deficit weighing on the single currency after the Italian government agreed to set a higher than expected budget deficit target. Currency gave up nearly 1.2 percent last week.

- The yen touched to 113.96 per dollar, reaching its lowest since the middle of November 2017 before paring some losses. It last traded 0.2 percent higher at 113.90 per dollar.

Global Markets

- Brent crude oil prices rose to their highest since November 2014 on Monday ahead of U.S. sanctions against Iran, the third-largest producer in the Organization of the Petroleum Exporting Countries (OPEC), that kick in next month.

- Gold inched higher but was on track for its longest monthly losing streak since January 1997 as the U.S. dollar firmed against the euro after Italy's budget jitters threatened the European currency. Bullion is down more than 0.5 percent in September, its sixth straight monthly loss.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 72.81 | 72.81 | 0.35 |

| EUR/USD | 1.15928 | 84.40 | 0.24 |

| GBP/USD | 1.30261 | 94.84 | 0.41 |

| USD/JPY | 113.866 | 0.64 | 0.23 |

| SEK/INR | 8.9033 | 8.1779 | 0.0184 |

| DKK/INR | 6.4347 | 11.32 | 0.0399 |

| AUD/USD | 1.3862 | 52.51 | 0.83 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.26056 | -0.40243 | |

| 3M | 2.39838 | -0.353 | |

| 6M | 2.60388 | -0.314 | 1Y | 2.91863 | -0.21329 |

| Index | Today | % Change |

| NIFTY | 10896.8 | -0.31 |

| SENSEX | 36159.78 | -0.19 |

| BANK NIFTY | 24935.3 | -0.73 |

| SGX NIFTY | 10986 | 0.09 |

| NIKKEI | 24120.04 | 1.36 |

| HANG SENG | 27788.52 | 0.26 |

| SHANGHAI | 2821.3498 | 1.06 |

| ASX200 | 6156.7 | -0.82 |

| DOW JONES | 26458.31 | 0.07 |

| S&P500 # | 2913.98 | 0.00 |

| NASDAQ # | 7627.65 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 01-10-2018 | 13.25 | EUR | German Manufacturing PMI (Sep) | 53.7 | 53.7 |

| 01-10-2018 | 14.00 | GBP | Manufacturing PMI (Sep) | 52.5 | 52.8 |

| 01-10-2018 | 19.30 | GBP | ISM Manufacturing PMI (Sep) | 60.3 | 61.3 |