India Rupee Slips Before Interim Budget, Fiscal Projections Eyed

1 February 2019 / Morning Brief

Indian Rupee

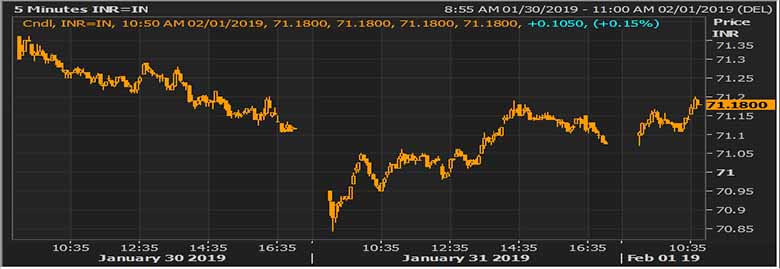

- The Indian rupee little changed at 71.10 pair now at 71.13 against 71.0750 previous close.

- Pair to tip in 70.80-71.40 range today.

- The Indian rupee was slightly lower against the dollar in early trade, as investors awaited the fiscal deficit estimates, which the government will detail in today’s interim budget announcement. All eyes will be on the fiscal deficit numbers, while any comments on farm loan package and its impact on the fiscal deficit for next year will drive the rupee. We expect a volatile session and will not be surprised if the central bank is present on both sides of the trade to curb volatility.

Global Currency

- India's financial markets were steady on Friday morning as traders remained on the sidelines, awaiting details on the extent to which the government will spend on populist measures in a pre-election budget due later in the day.

- Prime Minister Narendra Modi's government is expected to try and shore up its political support with big ticket farm giveaways and tax cuts for the middle class in its final federal budget on Friday, months before elections. by opposition parties' victories in three state polls in December and an impending national elections by May, Modi has already exempted many small businesses from paying taxes under a unified goods and services tax (GST). He is likely to do more to win back more voters including farmers and youth.

Global Markets

- Oil prices held steady on Friday, torn between hopes the US and China could soon settle their trade disputes and new data raising fresh concerns over China's economic slowdown. Crude oil were at $60.87 per barrel.

- First it was palladium's turn and now gold is racing to new highs above $1,300 an ounce, leaving other precious metals in the dust. Gold chalked up its fifth-straight day of gains as January trading.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 71.1775 | 71.1925 | 0.32 |

| EUR/USD | 1.14409 | 81.40 | 0.2 |

| GBP/USD | 1.30956 | 93.15 | 0.19 |

| USD/JPY | 108.858 | 0.65 | 0.24 |

| SEK/INR | 9.0579 | 7.8581 | 0.0135 |

| DKK/INR | 6.3537 | 11.2025 | 0.0325 |

| AUD/USD | 1.3815 | 51.51 | 0.13 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.50913 | -0.42229 | |

| 3M | 2.73625 | -0.34286 | |

| 6M | 2.8115 | -0.29229 | 1Y | 3.02063 | -0.17 |

| Index | Today | % Change |

| NIFTY | 10869.6 | 0.36 |

| SENSEX | 36404.79 | 0.41 |

| BANK NIFTY | 27304.95 | 0.03 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 20773.49 | 1.06 |

| HANG SENG | 27854.79 | -0.31 |

| SHANGHAI | 2604.5748 | 0.77 |

| ASX200 | 5862 | -0.05 |

| DOW JONES | 24999.67 | -0.06 |

| S&P500 # | 2704.1 | 0.86 |

| NASDAQ # | 6906.839 | 1.45 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 01-Feb-2019 | 14.25 | EUR | German Manufacturing PMI (Jan) | 49.9 | 49.9 |

| 01-Feb-2019 | 15.00 | GBP | Manufacturing PMI (Jan) | 53.5 | 54.2 |

| 01-Feb-2019 | Tentative | EUR | CPI (YoY) (Jan) | 1.4% | 1.6% |

| 01-Feb-2019 | 19.00 | USD | Nonfarm Payrolls (Jan) | 165K | 312K |

| 01-Feb-2019 | 19.00 | USD | Unemployment Rate (Jan) | 3.9% | 3.9% |